New NCAA Guidance, Financial Literacy, Social Media, and Entrepreneurism

Name, Image, Likeness Insider uses proprietary data and expert insights to explain the latest NIL developments.

STUDENT-ATHLETE EDUCATION MAY FINALLY BE GETTING ITS DUE

As they’ve done one time before, on October 26, 2022, the NCAA provided new guidance on NIL activities. Last time they focused on boosters and collectives. This time the focus is on what is/is not permissible for institutions - including coaches and staff - in terms of their NIL participation.

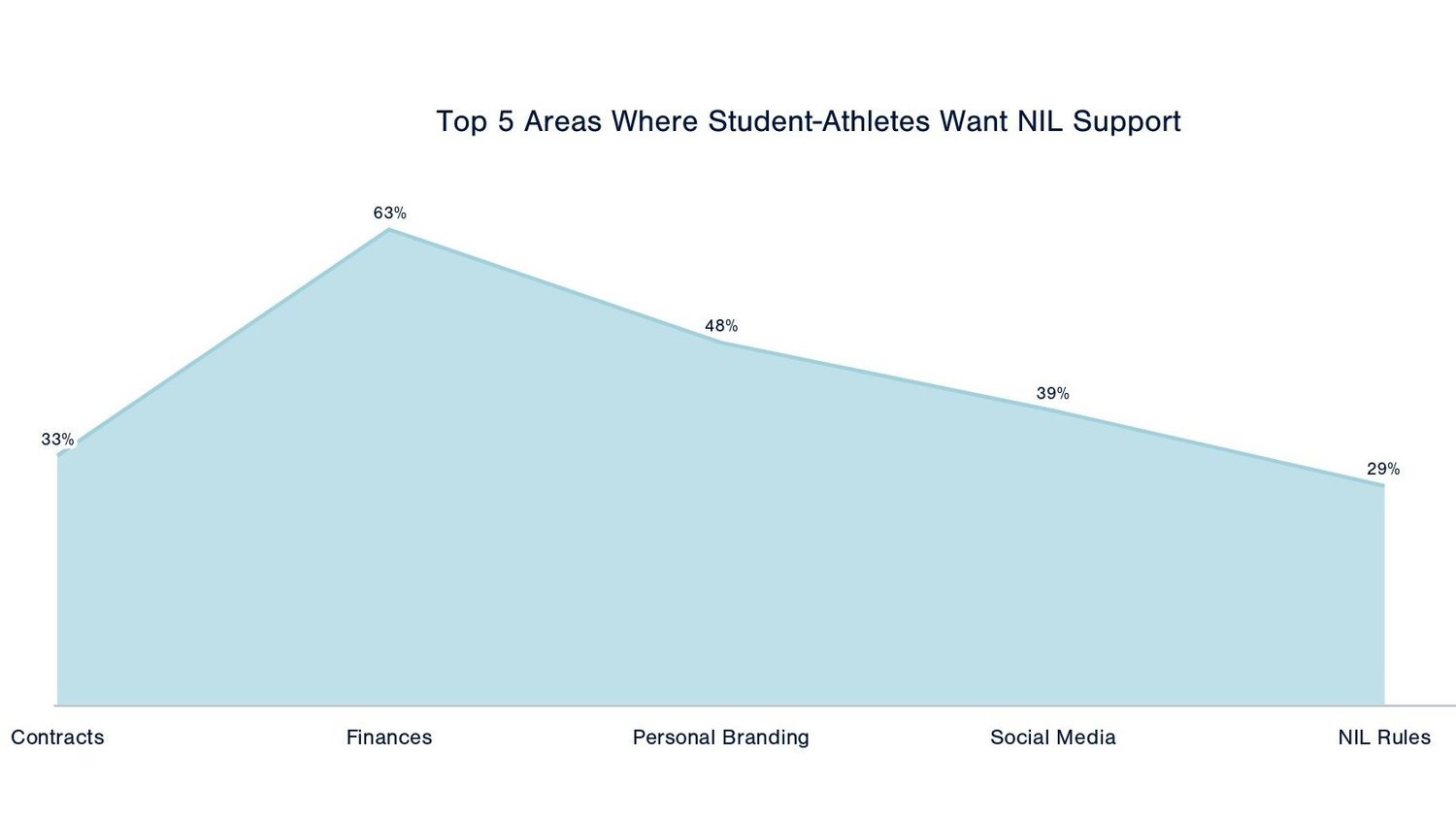

While the NCAA’s latest clarification touched on a range of issues, the priority seems to be on educating student-athletes “on topics like financial literacy, taxes, social media practices and entrepreneurship.” Seeing them lead off in the first paragraph talking about the education of student-athlete (and boosters, collectives, and prospects too!) is music to the ears of those of us who have been studying where NIL is falling short. (To see the laundry list of other permissible/impermissible actions for institutions, click here.)

And wouldn’t you know 🙄, I have data with regard to the what student-athletes want and need with regard to education around financial literacy/taxes, social media, and entrepreneurship. So here we go!

4 THINGS TO KEEP IN MIND WHEN TALKING ABOUT FINANCIAL LITERACY

When I surveyed over 1,000 student-athletes in the Spring 2022, I found that only 36% of student-athletes said they feel highly confident about their financial knowledge, but they understand the importance of financial literacy and wanted to learn more.

THEIR IMMEDIATE FINANCIAL GOALS

In what is music to the ears of financial advisors and parents alike, the #1 financial goal of student-athletes is saving money. #2 on the list is growing their income - whether by way of a summer job, a side-hustle, or an NIL opportunity. And #3 is learning about investing (only 31% of student-athletes said they understand how the stock market works.)

THEY DON'T KNOW ENOUGH ABOUT TAXES

About 2/3rds of student-athletes cannot explain the difference between an employee and an independent contractor. Of critical concern is that about 70% of student-athletes don’t know about quarterly tax payments. 64% of student-athletes who want to invest say what’s holding them back is not knowing where to start.

YIKES! WHERE STUDENT-ATHLETES GET FINANCIAL INFO

Student-Athletes are part of a “self-learning” culture - which has both benefits and drawbacks. The current sources of financial information that student-athletes most use are: YouTube, friends & family, and TikTok. And let’s remember that there are no credentials or training required for these sources when they talk about budgeting, saving, or anything else.

WHY ISN’T ANYONE TALKING ABOUT FINANCIAL AID?

Lip service or not, at least people talk about financial literacy for student-athletes. But I almost never hear about including financial aid into the conversation, despite that about 50% of all student-athletes receive some sort of financial aid. NIL is taxable income that impacts student-athletes who apply for need-based school, state, or federal financial aid or the Pell Grant. For many student-athletes, the impact of NIL on their financial aid application will be more significant than the impact on their tax return.

WE ARE FALLING SHORT ON TEACHING SOCIAL MEDIA

80% of all NIL activities are social media. And student-athletes are over-delivering on social media compared to other other social media influencers. According to Influencer Marketing Hub’s studies, 1.7% is the average engagement rate for social media influencers. The average engagement rate of student-athletes posting on behalf of brands is 5.4%.

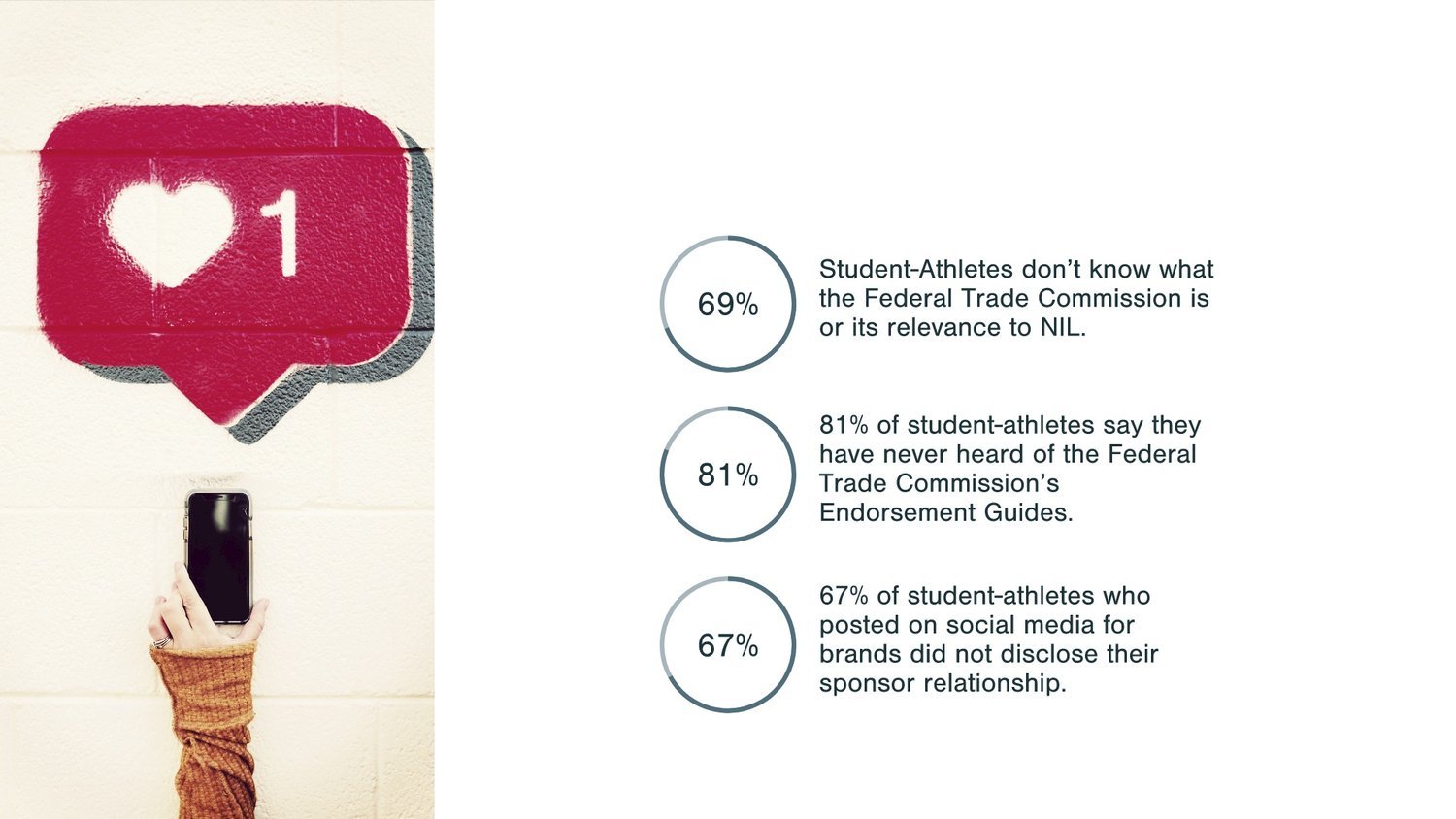

But when it comes to educating student-athletes about social media best practices, we are falling short. For example, few student-athletes who participate in social media-related NIL activities know that they are obligated to follow Federal Trade Commission (FTC) rules. The FTC’s mission is to protect consumers. And in that role, they have developed Endorsement Guides to help endorsers (now including student-athletes) to stop deceptive ads. The FTC’s rules for social media influencers are straightforward and I’ve summarized them here:

Student-Athletes cannot talk about their experience with a product unless they actually have experience with it; what they talk about must be their honest belief

Student-Athletes cannot make statements about a sponsor’s product that the sponsor cannot prove

Student-Athletes must always disclose that they have a relationship with the sponsor so that people can weigh the value of their endorsement

Failure by student-athletes to disclose their relationship with a sponsor puts the student-athlete in danger of the FTC’s financial and other penalties.

YES TO TEACHING ENTREPRENEURSHIP, BUT DON’T STOP THERE

In studies I’ve conducted over the last year, I have seen as high as 70% of student-athletes say they have an interest in entrepreneurship and starting their own businesses. Using NIL to teach student-athletes how to become entrepreneurs - whether to capitalize on Name, Image, Likeness or create a startup in the future - is seizing on a great learning opportunity.

But teaching about entrepreneurship feels like a bit of luxury, particularly when we know that student-athletes need support and education right now on issues like contracts and personal branding. So yes, I say teach it all, but understand that some of what needs to be taught are pressing issues based on the NIL ecosystem that we created - so let’s start there.

Bill teaches NIL in College Sports at the University of Vermont’s Grossman School of Business. He consults with brands, universities, and sports organizations on Name, Image, and Likeness - and provides on-demand courses for parents, athletes, coaches & administrators. Bill’s a SportsBusiness Journal Forty Under 40 Award winner and former co-founder of the athlete & event marketing agency Fuse, which he operated for 20+ years before selling in 2019.