Seven Data Points That Will Tell the Story of NIL in 2023

this originally appeared in nil corner, my monthly sports business journal column that moves beyond the headlines to discuss the data, trends, and people of nil. In this first edition, we look at seven key data points that challenge our assumptions about the direction of NIL in 2023.

During 2022, about 17% of student athletes at Division I institutions participated in NIL activities. That number might seem low given the “buzz” around NIL the last 18 months, but there’s evidence that the number of student athletes doing NIL deals is growing. Texas Tech AD Kirby Hocutt said that 278 student athletes at Texas Tech had disclosed NIL deals. That number, which he revealed last month at the Sports Business Journal Intercollegiate Athletics Forum, presented by Learfield, equates to around 40% of that institution’s student athletes. Whether Texas Tech is a bellwether for NIL growth should be more evident in 2023.

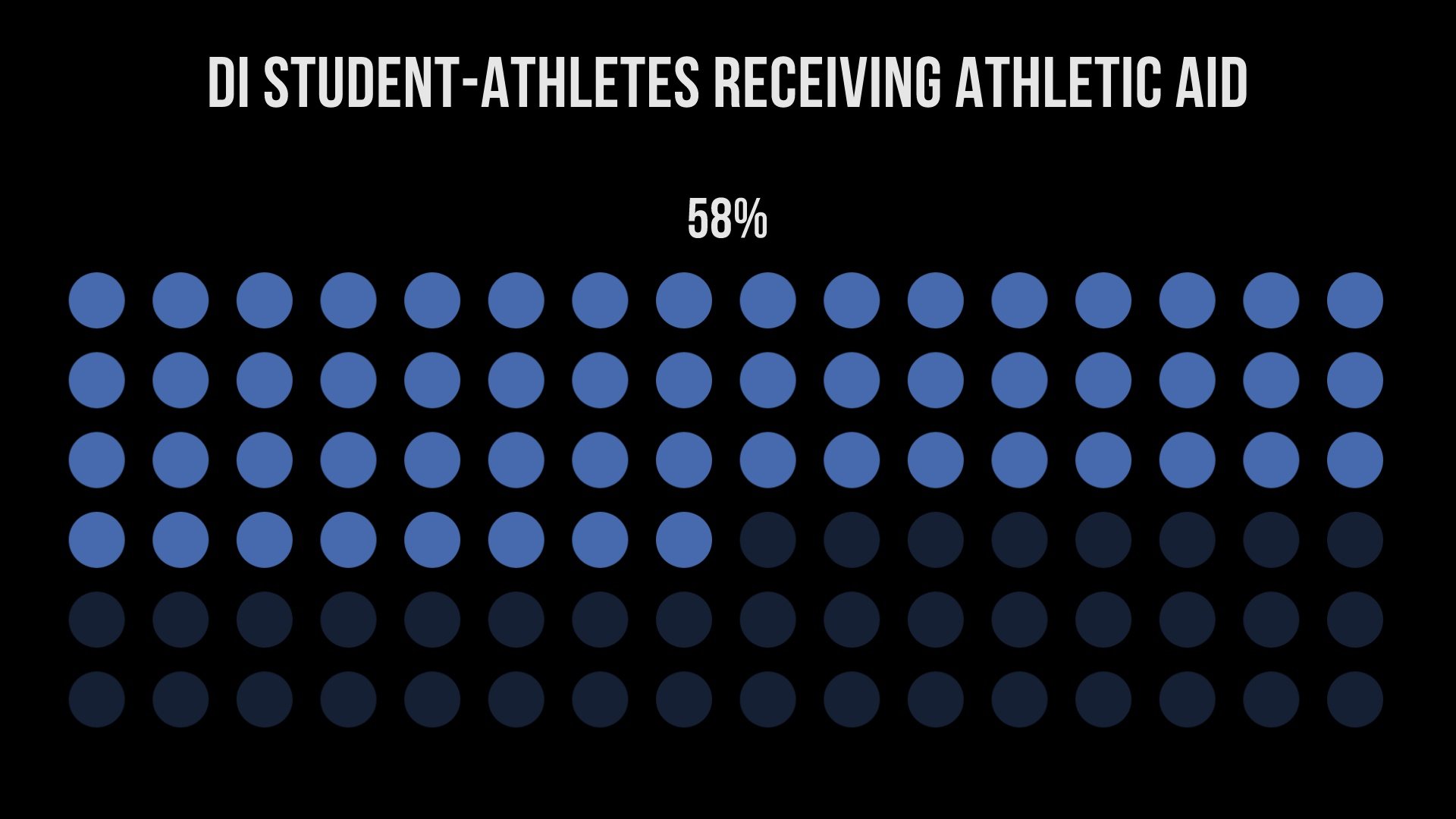

According to the NCAA, 58% of DI student athletes receive some athletic aid. The majority of student athletes receive partial scholarships — not “full rides” — and often supplement their athletic aid with need-based financial aid. Understanding scholarships and financial aid is important in realizing that NIL’s impact goes beyond high-profile athletes getting rich. Often, it’s Olympic/non-revenue sport athletes who are mitigating student debt by way of NIL opportunities. According to Ohio State’s AD Gene Smith: “Olympic sport athletes are benefiting the most from NIL.”

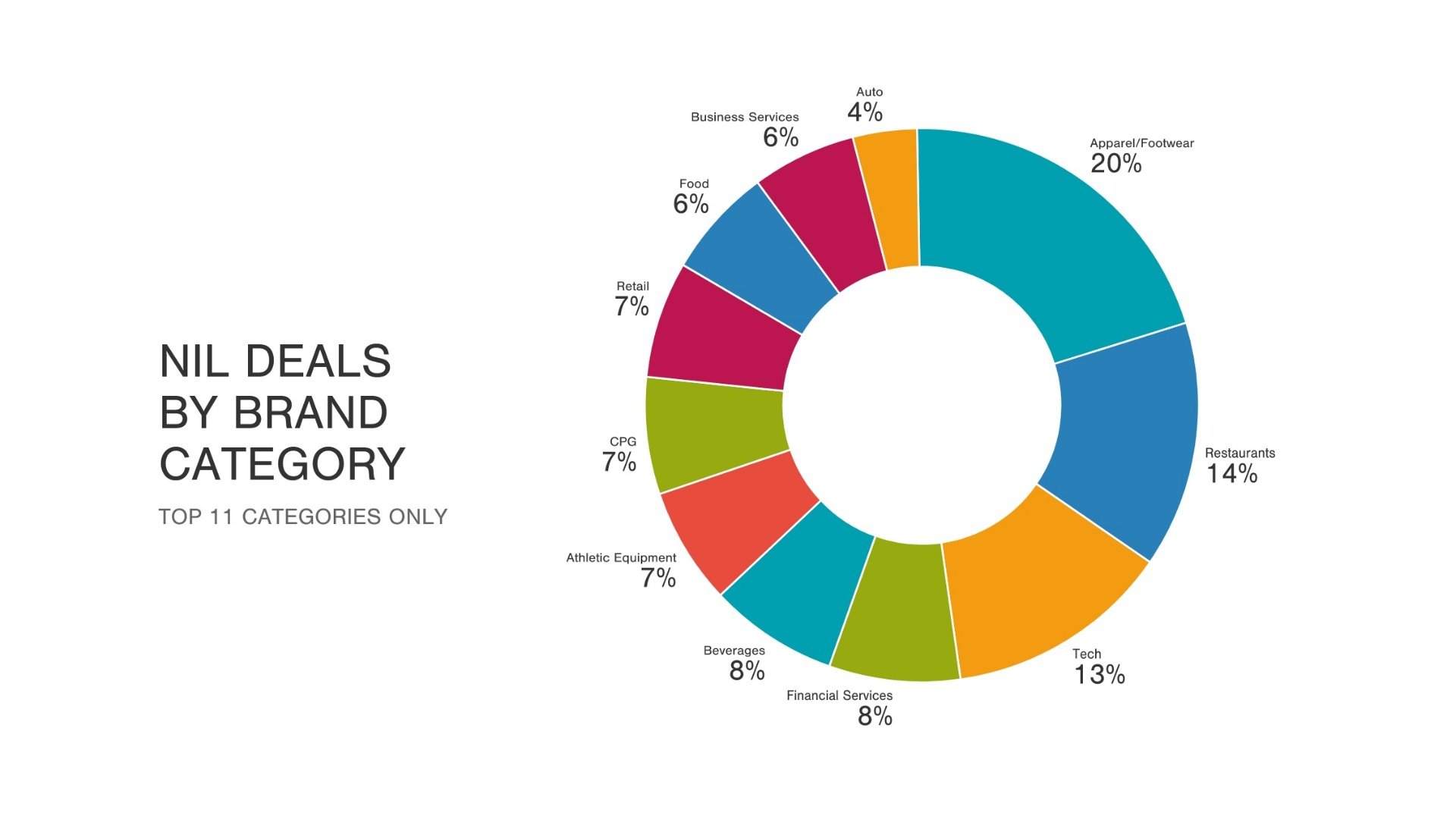

The leading category in 2022 was apparel/footwear, which accounted for 20% of all NIL activity. Despite the emphasis on local versus national deals, the industry categories leading NIL activity are relatively similar to the sports industry as a whole. Restaurants accounted for 14% of NIL deals, with quick service restaurants making up half of the restaurant total. Technology was third, with NFT deals prominent here. And for all the buzz about car deals (including those with dealerships), the auto category represented a relatively small 4% of the total. Financial services was within the top five categories at a healthy 8% of the total.

Collectives are here to stay and the NCAA and its members are adapting to this reality. While there remains some angst among schools about the use of NIL money as potential inducements for high school prospects and athletes coming through the transfer portal, it’s now common to see ADs openly supporting the role of collectives, particularly those that are nonprofits and/or create community service opportunities.

There are 201 NIL collectives operating today, according to Andy Wittry at On3. This total includes both booster-led collectives that emerged within days of the NCAA issuing its NIL Interim Policy and player-led “clubs” that allow fans to support athletes through subscriptions in exchange for various fan experiences.

After the NCAA published guidance in May 2022 titled “Interim Name, Image and Likeness Policy Guidance Regarding Third Party Involvement,” athletic departments’ views of collectives began to evolve rapidly and that evolution will be evident throughout 2023.

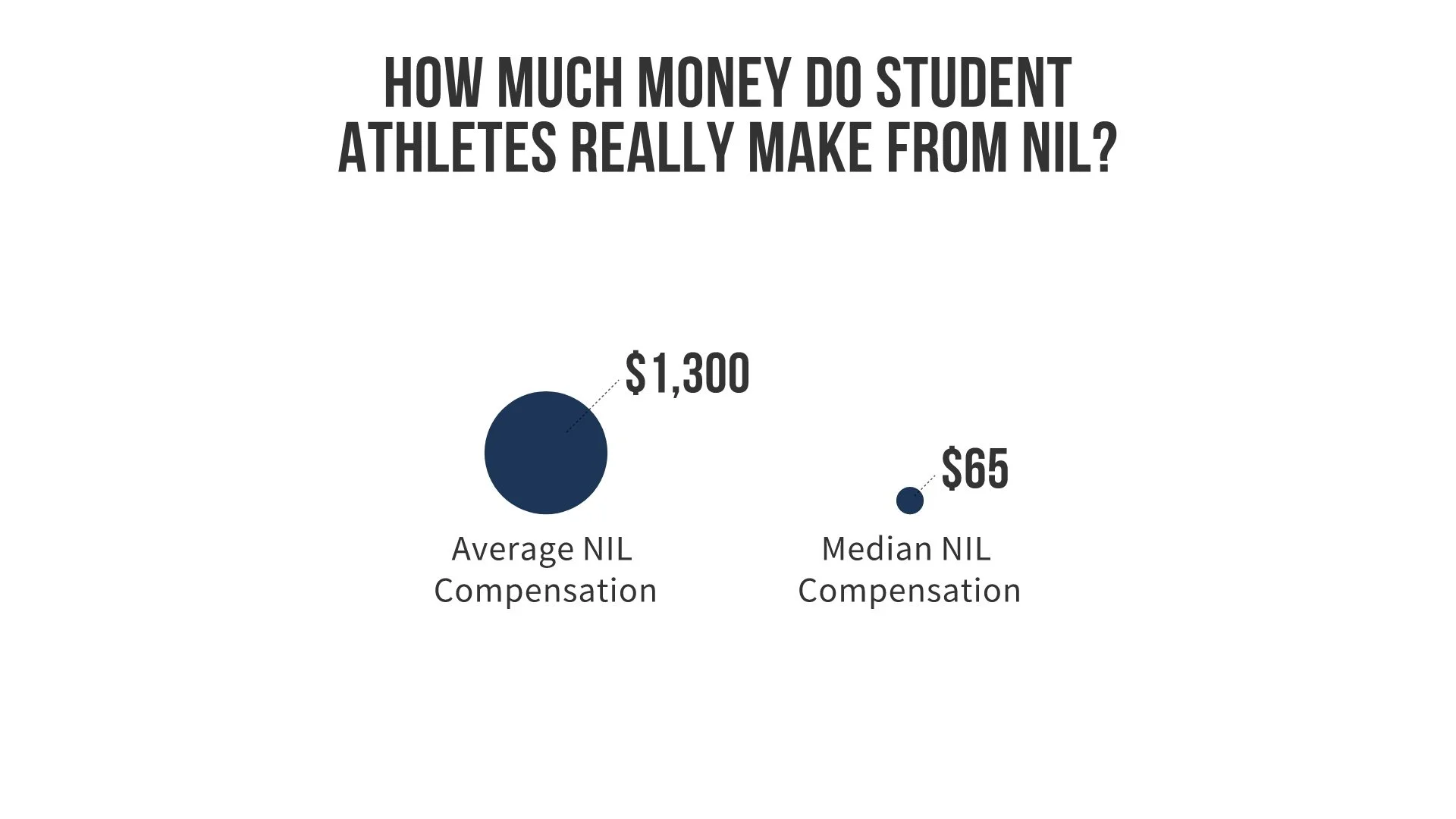

How much money do student athletes really make from NIL? According to the NIL marketplace Opendorse, the average compensation for student athletes on their platform was about $1,300 per deal in Year 1 of NIL. It should be clear that averages can be inflated due to very large deals by a handful of student athletes when analyzing data like this.

I like to also consider the median compensation too. (As a reminder, the median is the middle number in a sorted list of numbers and can often be a better representation of the data than the average.) In numerous 2022 surveys I conducted, the median compensation for DI student athletes was about $65 per NIL activity.

Social media represents nearly three-quarters of all NIL activity. The kinds of social media activities can be segmented into three types:

1. Social media “influencers," where a brand pays a student athlete to post content.

2. A student athlete’s use of social media to promote their own brand or merchandise.

3. The use of social media like Cameo to sell content directly to consumers.

Rounding out the top five NIL activities are: endorsements, appearances, instruction (camps, clinics, private instruction) and student athlete merchandise sales.

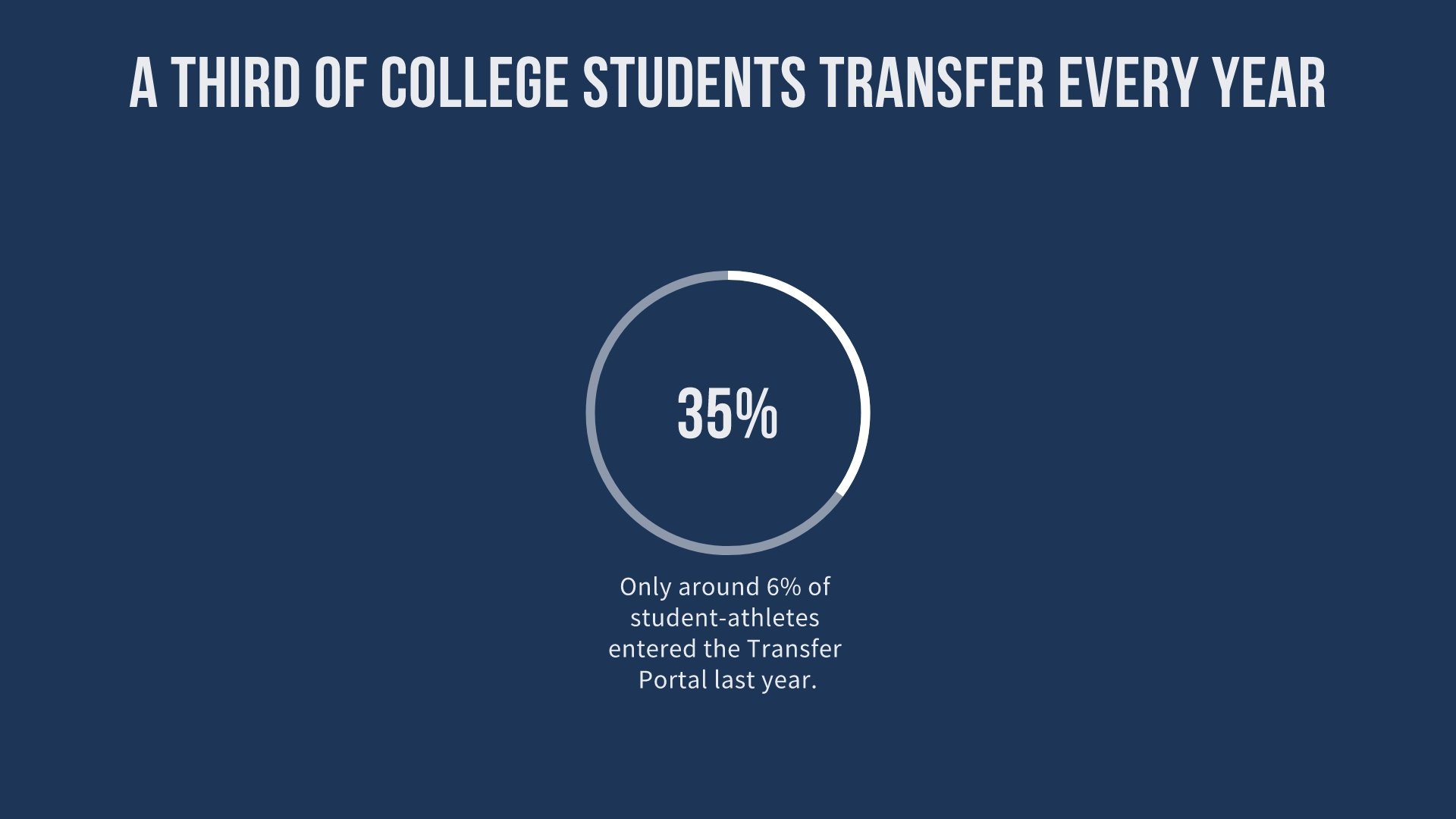

With daily updates, rankings, and breaking news, the transfer portal is woven into nearly every conversation about NIL. Over 1,000 football players entered the portal in its first week, but in the big picture that is all of college sports, the number of student athletes in the transfer portal seems less dramatic.

Historically, 30%-35% of the general college student population transfers each year. In comparison, last year’s portal had about 9,500 student athletes in it or 5.4% of the 176,000 DI athletes. Those numbers will no doubt be bigger this year (2022-2023) — we don’t know how much bigger yet. But the portal would need to have nearly 53,000 student athletes enter it to be on par with the general college student population transfer rate.

The bigger concerns about the transfer portal are:

1. The alleged tampering by coaches and collectives to induce athletes to choose their programs.

2. The unwillingness of coaches and student athletes, who witness inducements and other rule-breaking, to provide actionable information to the NCAA’s enforcement staff.

A goal of the transfer portal ought not to be reducing the number of athletes using it. Rather, we need all stakeholders to help enforce the rules to operate it more fairly.

Bill Carter is an NIL Consultant, Educator, Speaker, and Columnist for Sports Business Journal. He also teaches NIL in College Sports at the University of Vermont’s Grossman School of Business. Bill’s a SportsBusiness Journal Forty Under 40 Award winner and former co-founder of the athlete & event marketing agency Fuse, which he operated for 20+ years before selling in 2019.